Bookkeeping & Accounting

In the crucible of financial management, the transformation of data into business gold is an ongoing process. It requires dedication to accurate record-keeping, a commitment to sophisticated analysis, and a forward-thinking approach to financial planning. As businesses embrace the potential of their financial data, they embark on a journey of continual improvement, turning every piece of information into a valuable asset that propels them toward prosperity in the competitive marketplace.

Does my small business need an accountant or a Bookkeeper?

YES! Maintaining bookkeeping is integral to the operation of a small business. Even if expansion isn't on the immediate horizon, understanding the balance between incoming and outgoing funds is crucial. Additionally, the data compiled through bookkeeping is indispensable for accurately filing your taxes.

Should I get a bookkeeper or an accountant?

Bookkeepers and accountants share the same long-term goal of helping your business financially thrive, but their roles are distinct. Bookkeepers focus more on daily responsibilities, like recording transactions, while accountants provide overarching financial advice and tax guidance.

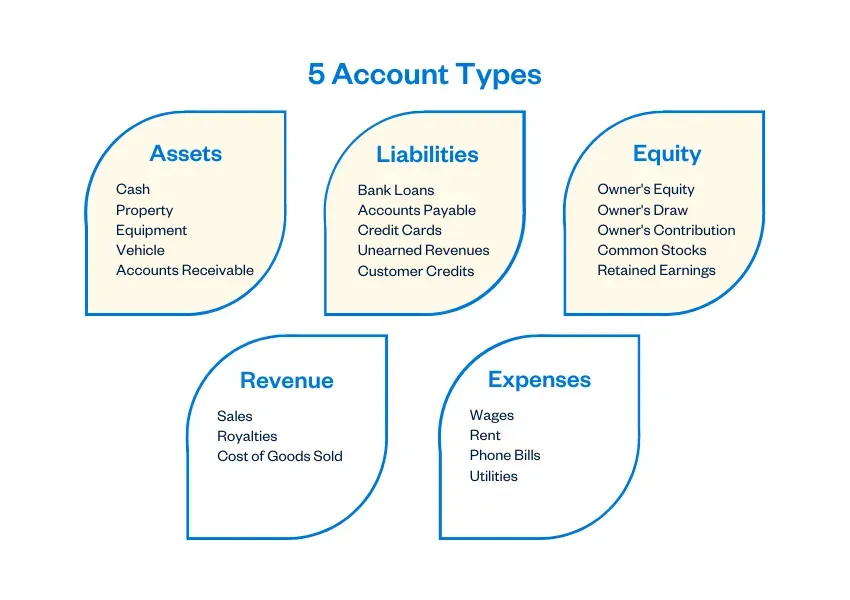

what are the three main types of accounts?

Real, Nominal and Personal

What Is Accounting?

Accounting is the process of recording financial transactions pertaining to a business. The accounting process includes summarizing, analyzing, and reporting these transactions to oversight agencies, regulators, and tax collection entities.

Why Accounting Is Important?

Accounting is necessary for company growth

Accounting is necessary for funding.

Accounting is necessary for owner exit.

Accounting is necessary to make payments.

Accounting is necessary to collect payments.

Accounting may be required.

tips to help manage your finances effectively

Establish a Solid Bookkeeping System

Implement a systematic and organized bookkeeping system from the start. This includes recording all financial transactions, categorizing expenses, and keeping detailed records of income. Utilize accounting software or tools to streamline the process and ensure accuracy.

Regularly Reconcile Accounts

Reconcile your bank statements, credit card statements, and any other financial accounts regularly. This ensures that your records align with actual transactions, helping to identify discrepancies or errors promptly. Consistent reconciliation is a fundamental practice in maintaining financial accuracy.

Create and Stick to a Budget

Develop a comprehensive budget that outlines your income, fixed and variable expenses, savings goals, and debt repayment plans. Regularly review and adjust the budget as needed. This not only guides day-to-day spending but also supports long-term financial planning.

Understand Key Financial Ratios

Familiarize yourself with key financial ratios, such as the debt-to-equity ratio, current ratio, and gross profit margin. These ratios provide insights into your business's financial health and performance. For personal finances, consider ratios like debt-to-income and savings ratio.

Consult with a Professional

Engage with a qualified accountant or financial advisor to gain expert insights into your financial situation. Professionals can provide guidance on tax planning, investment strategies, and overall financial management. Regular consultations can help you make informed decisions and optimize your financial position.

Remember, effective financial management involves a combination of meticulous

bookkeeping, strategic accounting practices, and a proactive approach to budgeting and planning.